It’s that time of year when the city administration finalizes the budget for next year.

When looking at budgets, it’s easy for eyes to glaze over spreadsheets and get turned around by the complexity of it all. At the same time, budgets are useful documents for determining the local government’s priorities and understanding what challenges the city faces.

The biggest takeaway from budget conversations this year is that due to an apparent flatlining of sales tax revenue, it could be a lean few years for core city services.

Draft budgets for 2026 were presented to City Council during workshops earlier this month and could be approved later this month or potentially next, due to upcoming holidays. During the workshops, each individual department presented its plans for next year.

Technically, there are a few different budgets.

The city prepares a few separate budgets each year.

For most purposes, the city’s general fund budget is what people mean when they refer to “the budget.”

This budget includes most of the core services the city provides, including police and fire services, city planning, parks, city administration and the library. It’s funded primarily by local sales and property taxes. Essentially, this budget is where your tax money goes.

What this budget doesn’t include:

Bentonville’s city-run water and electric utilities are “enterprise funds,” which basically means they’re treated as businesses that should be self-supporting. The utilities have their own budget, and they’re expected to cover their own costs through bills and fees charged to customers without relying on tax revenue. When the utility departments need more revenue, they increase customers' bills. That’s exactly what happened for electric, water and sewer rates this year.

Roads are primarily funded by special taxes on gas and funds received from the state government. For this reason, road maintenance has its own budget of about $8 million.

Spending Breakdown

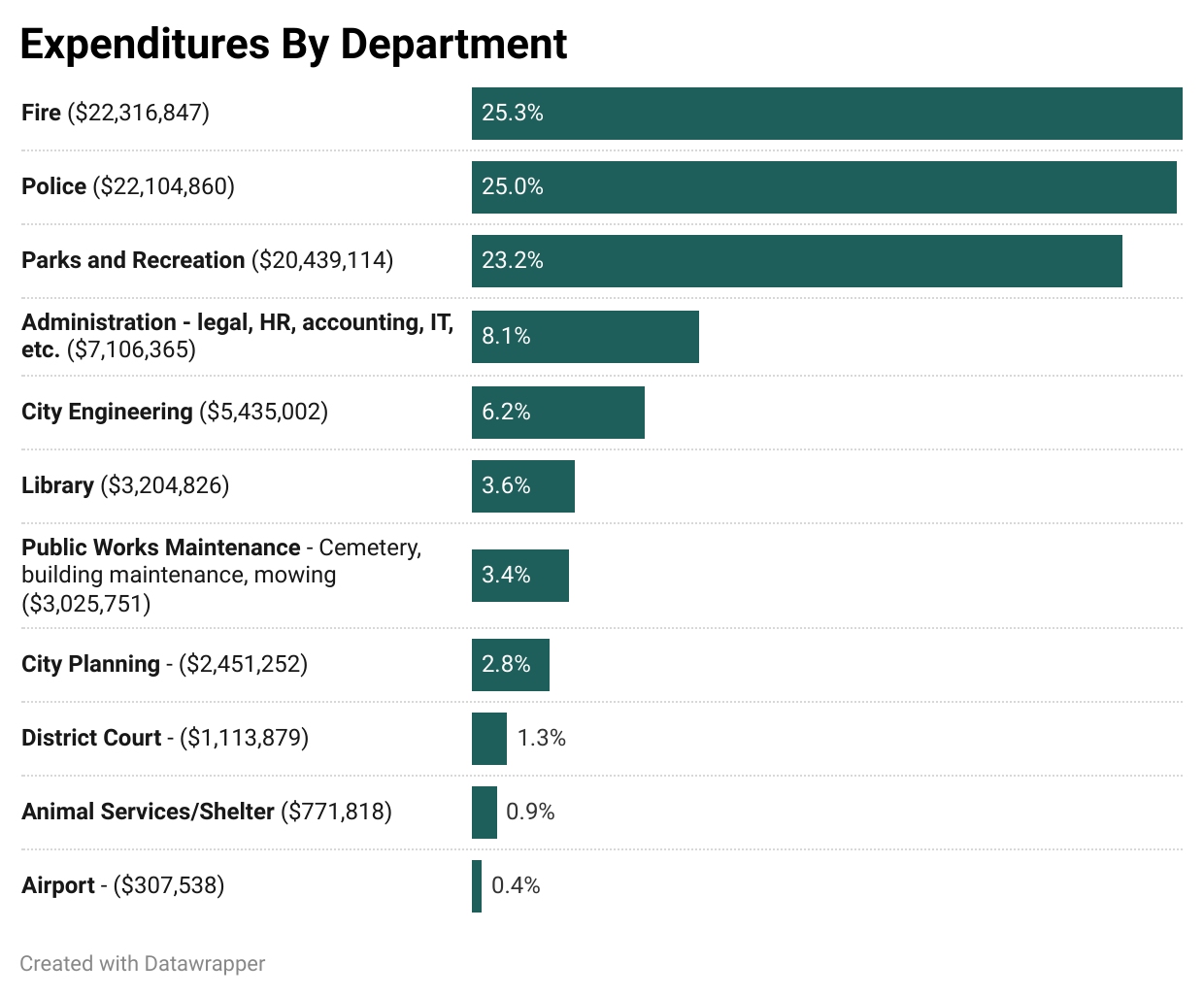

Here’s where the money in the general fund budget is spent, broken down by department:

This breakdown is more or less the same as in recent years.

As services provided to residents, few of these departments are expected to generate significant revenue, and none are expected to bring in more than they spend.

The district court is expected to cover about 40% of its expenses with fines, and the municipal airport is expected to cover about 90% of its operating expenses with leases and other services. The parks and recreation department is expected to generate the most revenue overall, with program income and impact fees projected to bring in about $7.8 million, roughly 40% of the cost of running the department.

By far the largest expense is staff salaries and benefits at 63% of the budget. The 2026 budget includes a 3.5% cost of living increase for city employees. Three new staff positions are also being added, all in the police department.

The budget is tighter than before due to flatlining of sales tax revenue.

While there are accessory revenue streams, the majority of funding for the core services in the general fund comes from sales taxes.

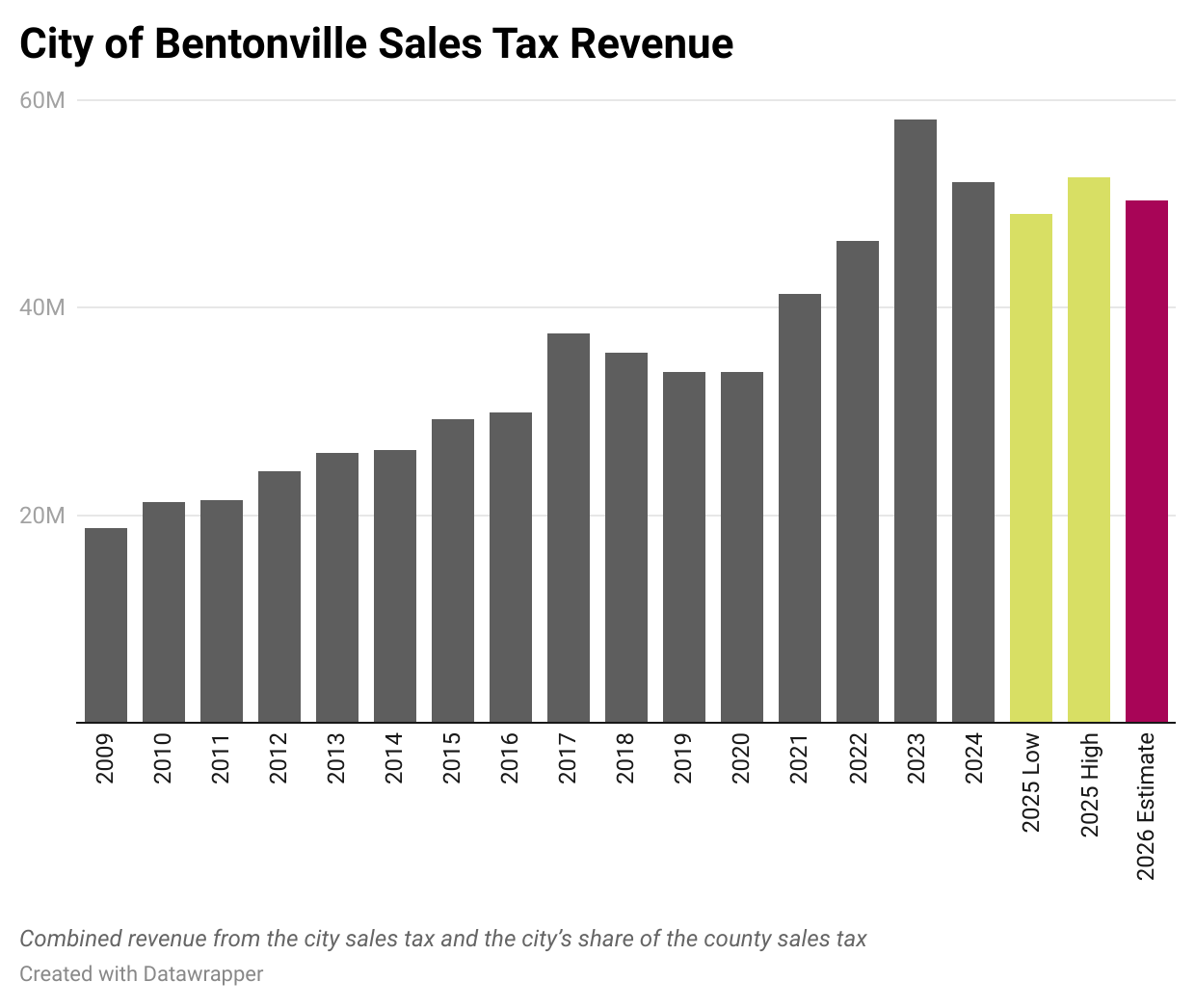

For more than a decade, the City of Bentonville’s sales tax revenue had been on an upward trend, with meaningful growth most years.

However, this is no longer something the city can count on anymore.

The 2025 sales tax projection includes high and low estimates, shown as two yellow bars. The 2026 estimate is shown in pink.

Sales tax revenue doesn’t seem to be going up in the same way it was before, in part because of sales tax rebates.

To encourage economic development, many business expenses over $2,500 qualify for sales tax rebates under state law. The city has to refund 100% of the sales tax revenue it got from the purchase on the amount exceeding $2,500.

Some of the sales tax revenue collected in the past couple years ended up being a mirage. The city got that money, but millions had to be paid back this year in rebates for purchases made in prior years, due to an unusual set of circumstances.

More businesses are finding out about the eligibility rules for sales tax rebates, and, as The Bentonville Bulletin previously reported, entire companies have been created to help them take advantage of the rebates.

Armed with more insight about the intricacies and risks of sales tax rebates, the 2026 budget attempts to better account for potential sales tax rebates.

City Finance Director Patrick Johndrow said the city is looking for ways to save money without diminishing services.

“We're going through, and we're doing things to not diminish services,” Johndrow said. “Nobody should know if we have less people doing their job than we used to, just as long as the services are kept on.”

A few specific examples of savings presented during public budget-review workshops on November 7:

The police department plans to keep vehicles in service longer, reducing the need for replacements this year.

The IT department is saving about $120,000 annually by renegotiating cell phone contracts. It’s also saving by buying equipment less often but in larger quantities to gain negotiating power, cutting unneeded fax and landline lines, and reviewing software contracts.

The public works department, which is responsible for mowing and maintaining numerous properties and rights-of-way throughout the city, is deferring the purchase of new mowers and vehicles for now.

The parks and recreation department plans to open the new adult recreation center, the 8th Street Gateway Park and the reimagined Dave Peel Park in 2026. Custodial services are being outsourced, maintenance and landscaping costs were trimmed and a local nonprofit absorbed a trail and master planner position that was previously managed by city staff. The result is a department budget that increases by about 1% but is expected to be offset by higher revenues.

"It's not doomsday. It's just, this is the money we got, and this is how we're going to provide services, right?” Johndrow said.

For meaningful sales tax growth, the city needs to focus on adding retail, he said.

Growing the local retail sector is a core focus of a new economic development strategy recently presented by Chamber of Commerce CEO Brandom Gengelbach. The strategy is being designed in partnership with the city government.

Even still, it will be several years before that strategy could begin to yield results for the city.